Cryptocurrency trading has become a popular investment avenue, and with the increasing demand for automation, many traders are looking for ways to make their trading experience more efficient. One of the most innovative tools for this is a crypto trading bot. But how exactly do you build a crypto trading bot, especially if you’re based in the USA? In this guide, we’ll walk you through the process of creating your very own crypto trading bot to automate your trades and maximize your potential profits.

What is a Crypto Trading Bot?

Before diving into the technical aspects of how to build a crypto trading bot, let’s first understand what it is. A crypto trading bot is a software application designed to automate cryptocurrency trading. It uses algorithms to buy and sell cryptocurrencies on your behalf based on predefined criteria, such as market trends, price fluctuations, and technical indicators.

These bots can work 24/7, executing trades even when you are asleep, making them an essential tool for busy traders or anyone looking to minimize emotional decision-making in their trading strategy.

Why Should You Build Your Own Crypto Trading Bot?

While there are numerous pre-built crypto trading bots available in the market, building your own offers several key advantages:

- Customization: You can tailor the bot to your specific trading strategies and preferences.

- Control: You have full control over the code and the ability to adjust it whenever you see fit.

- Cost Efficiency: Building your own bot may cost less in the long run, especially if you’re a serious trader.

Now that you know why building a crypto trading bot can be a game-changer, let’s dive into the steps required to create one.

Step 1: Determine Your Bot’s Purpose

The first step in creating a crypto trading bot is to define its purpose. What do you want the bot to achieve? There are several types of bots, and your choice will depend on your trading goals. Here are a few options:

- Arbitrage Bots: These bots take advantage of price differences between different cryptocurrency exchanges.

- Market-Making Bots: They place both buy and sell orders at certain price points to profit from the spread.

- Trend Following Bots: These bots follow market trends and execute trades based on signals like moving averages or RSI (Relative Strength Index).

Defining the purpose of your bot will help guide your development process and ensure that it aligns with your trading strategy.

Step 2: Choose a Programming Language

Now that you have a clear idea of your bot’s purpose, the next step is to select a programming language. Most crypto trading bots are built using languages that are well-suited for algorithmic trading, such as Python, JavaScript, or C++.

- Python is one of the most popular programming languages for building crypto trading bots due to its simplicity and extensive libraries for financial data analysis (like Pandas and NumPy).

- JavaScript is also a good choice, especially for those who are familiar with web development and need the bot to be accessible via a web interface.

- C++ offers high-speed execution, which is useful if your bot needs to react in real-time to market fluctuations.

For beginners, Python is usually the best option due to its simplicity and large community support.

Step 3: Set Up API Access

To make your bot work, it needs to connect to a cryptocurrency exchange where it will execute trades. Most exchanges provide APIs (Application Programming Interfaces) that allow third-party applications to interact with them programmatically.

Popular exchanges like Binance, Coinbase Pro, and Kraken provide well-documented APIs. To set up API access, follow these general steps:

- Create an Account: Sign up on your chosen exchange and enable 2FA (Two-Factor Authentication) for security.

- Generate API Keys: Go to the API section of the exchange’s dashboard and create a new set of API keys. Be sure to store these keys securely, as they grant access to your exchange account.

- Set Permissions: Assign permissions for your API keys based on what you want your bot to do. For example, if you want the bot to execute trades, you’ll need to enable “trade” permissions.

Once you’ve set up your API keys, you can use them to connect your crypto trading bot to the exchange.

Step 4: Develop Your Trading Algorithm

The heart of any crypto trading bot is its algorithm. This is where the magic happens. The algorithm tells your bot when to buy or sell a particular cryptocurrency based on the rules you define.

Here are some examples of common strategies that you can implement in your bot:

- Moving Average Crossover: The bot buys when the short-term moving average crosses above the long-term moving average and sells when the opposite happens.

- Relative Strength Index (RSI): The bot buys when the RSI is below 30 (indicating that the market is oversold) and sells when it’s above 70 (indicating that the market is overbought).

- Bollinger Bands: The bot buys when the price hits the lower band and sells when it hits the upper band.

These are just a few examples of strategies that you can code into your bot. If you’re new to algorithmic trading, it’s a good idea to start with simple strategies and gradually scale up as you gain more experience.

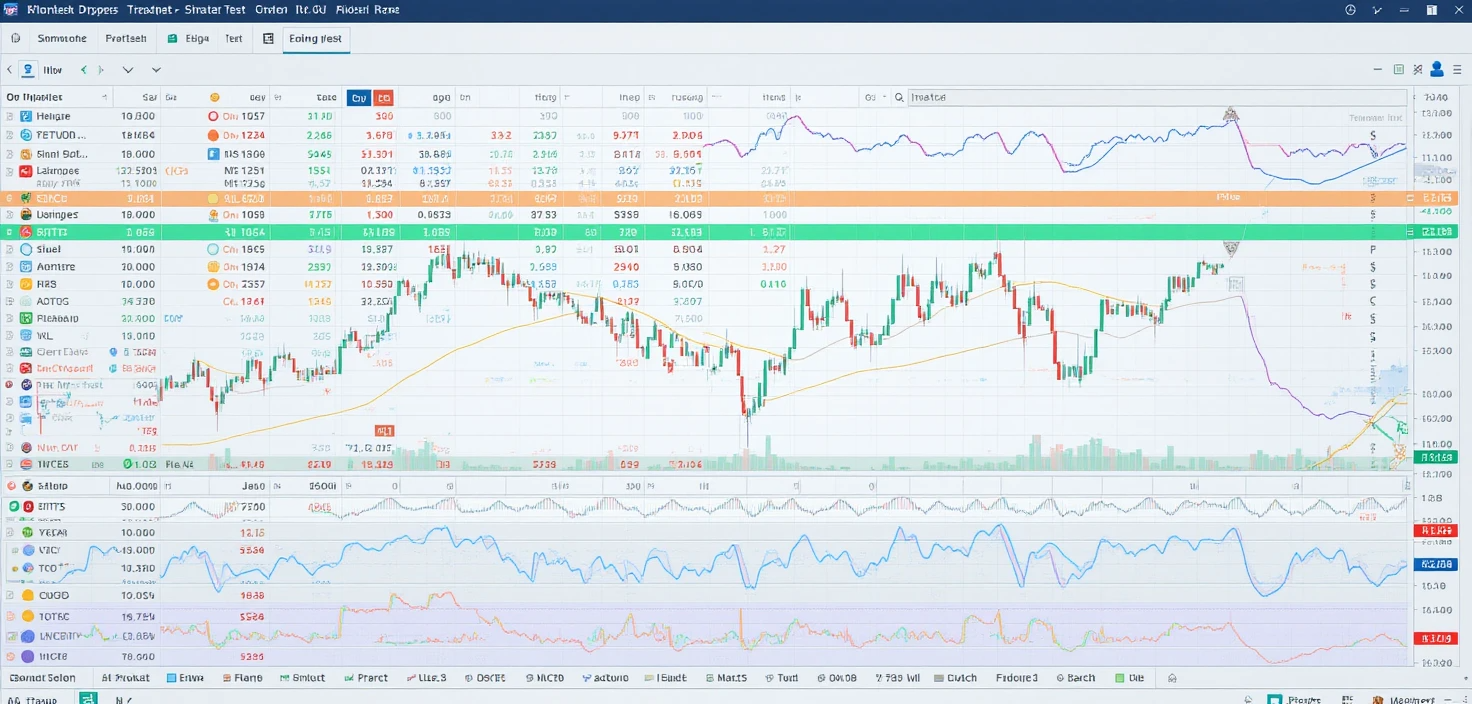

Step 5: Backtest Your Bot

Before you start trading with real money, it’s crucial to backtest your bot. Backtesting involves running your trading algorithm on historical data to see how it would have performed in the past. This helps you identify any flaws in your strategy and fine-tune your bot before deploying it in the live market.

Most crypto trading bots come with backtesting features, but if you’re building your bot from scratch, you can use libraries like Backtrader in Python to simulate your strategy with historical data.

Step 6: Implement Risk Management

Risk management is critical when building a crypto trading bot. While bots can automate the trading process, they can also expose you to significant risks if not properly configured. Some essential risk management strategies include:

- Stop-Loss: Automatically sell a position if the price falls below a certain threshold to limit losses.

- Take-Profit: Automatically sell when the price reaches a predefined profit target.

- Position Sizing: Only allocate a small percentage of your portfolio to each trade to prevent overexposure to one asset.

By implementing risk management rules, you can protect your investments while still benefiting from the efficiency of your crypto trading bot.

Step 7: Monitor and Optimize Your Bot

Once your crypto trading bot is up and running, it’s important to regularly monitor its performance. This will help you identify any issues or improvements that need to be made. Here are some best practices:

- Track Performance: Keep an eye on metrics like profit/loss, win rate, and drawdown.

- Optimize: Based on performance data, adjust your algorithm and risk management strategies as needed.

- Stay Updated: Ensure your bot remains compatible with any changes made by your chosen exchange’s API or trading rules.

Step 8: Go Live!

Finally, once you’ve thoroughly backtested and optimized your bot, it’s time to go live. Start with a small amount of capital to minimize risks and gradually increase your investment as you gain confidence in your bot’s performance.

Frequently Asked Questions

What is a crypto trading bot?

A crypto trading bot is an automated software application that buys and sells cryptocurrencies on your behalf based on predefined strategies. It uses algorithms to analyze market trends and execute trades without manual intervention, working 24/7 to help you capitalize on market opportunities.

How does a crypto trading bot work?

A crypto trading bot operates by connecting to your exchange account via an API. It analyzes market data, such as price fluctuations and technical indicators, and executes trades according to the rules you’ve programmed. The bot can follow specific strategies, such as trend following, arbitrage, or market-making, to make decisions on when to buy or sell.

Can I build a crypto trading bot without programming experience?

While some basic programming knowledge is helpful, it is possible to build a crypto trading bot with limited experience using pre-built libraries and frameworks. Platforms like Python provide simple libraries and tools for algorithmic trading that are well-suited for beginners, and there are many tutorials available to guide you.

What are the best programming languages for building a crypto trading bot?

Python is one of the most popular programming languages for building crypto trading bots due to its simplicity and extensive libraries for financial analysis. JavaScript and C++ are also commonly used, depending on your needs and familiarity with these languages. Python, however, is generally considered the best option for beginners.

Do I need to have a deep understanding of trading strategies to build a bot?

While a solid understanding of trading strategies is helpful, it’s not mandatory to create a basic crypto trading bot. You can start with simple strategies, like moving averages or RSI, and build up your knowledge as you gain experience. Many beginners begin by using pre-built algorithms and customizing them to suit their goals.

Is it safe to use a crypto trading bot?

Using a crypto trading bot is generally safe, as long as you take precautions to protect your API keys and ensure that your bot’s code is secure. Always use two-factor authentication (2FA) on your exchange account and only grant the bot the minimum permissions it needs to function. It’s also crucial to backtest your bot thoroughly before using real money.

What exchanges support crypto trading bots?

Most major cryptocurrency exchanges support trading bots through their APIs. Some popular exchanges that offer API access for bot integration include Binance, Coinbase Pro, Kraken, and Bitfinex. Be sure to check the API documentation for each exchange to understand its capabilities and limitations.

Can I build a crypto trading bot for free?

Yes, it’s possible to build a crypto trading bot for free, especially if you use open-source software and libraries. Programming languages like Python offer free libraries and frameworks for algorithmic trading. However, you may need to factor in costs for API access, hosting, or other third-party tools you may need.

How do I backtest my crypto trading bot?

Backtesting involves running your trading algorithm against historical market data to evaluate how it would have performed in the past. You can use backtesting platforms or libraries like Backtrader in Python to simulate your bot’s performance. Backtesting helps ensure that your bot’s strategy is effective before you risk real capital.

How much capital should I allocate to my crypto trading bot?

It’s advisable to start with a small amount of capital when you first deploy your crypto trading bot. Begin with an amount you are willing to lose, as crypto markets can be volatile. Once you gain confidence in your bot’s performance, you can increase your investment. Be sure to implement proper risk management to minimize potential losses.

Conclusion

Learning how to build a crypto trading bot is a great way to take your trading strategy to the next level. With the right tools, algorithms, and risk management strategies, you can create a bot that works for you 24/7, helping you take advantage of market opportunities even when you’re not at your desk.

Are you ready to build your own crypto trading bot? Start with a simple strategy and scale up as you learn more about algorithmic trading. With time, you’ll have a powerful tool at your fingertips that can help automate your trades and boost your trading profits.